Is Commercial Heat Treating Profitable?

The obvious answer to this question is that yes commercial heat treating can be quite profitable, however it can also be a very difficult way to make a living. Lets look at a real life example. The listing below is for a North American commercial heat treater currently on the market which “The Monty Heat Treat News” knows quite well (although we will make it clear that we have nothing to do with selling this company). This firm like many in the industry is family owned, has been in business for quite a number of years and is what we would consider a little smaller than the average heat treat, at least in North America. It is clean, well run in our opinion and has quite respectable equipment, like many commercial shops the equipment is a mix of new and used with more than half the equipment purchased new.

The obvious answer to this question is that yes commercial heat treating can be quite profitable, however it can also be a very difficult way to make a living. Lets look at a real life example. The listing below is for a North American commercial heat treater currently on the market which “The Monty Heat Treat News” knows quite well (although we will make it clear that we have nothing to do with selling this company). This firm like many in the industry is family owned, has been in business for quite a number of years and is what we would consider a little smaller than the average heat treat, at least in North America. It is clean, well run in our opinion and has quite respectable equipment, like many commercial shops the equipment is a mix of new and used with more than half the equipment purchased new.

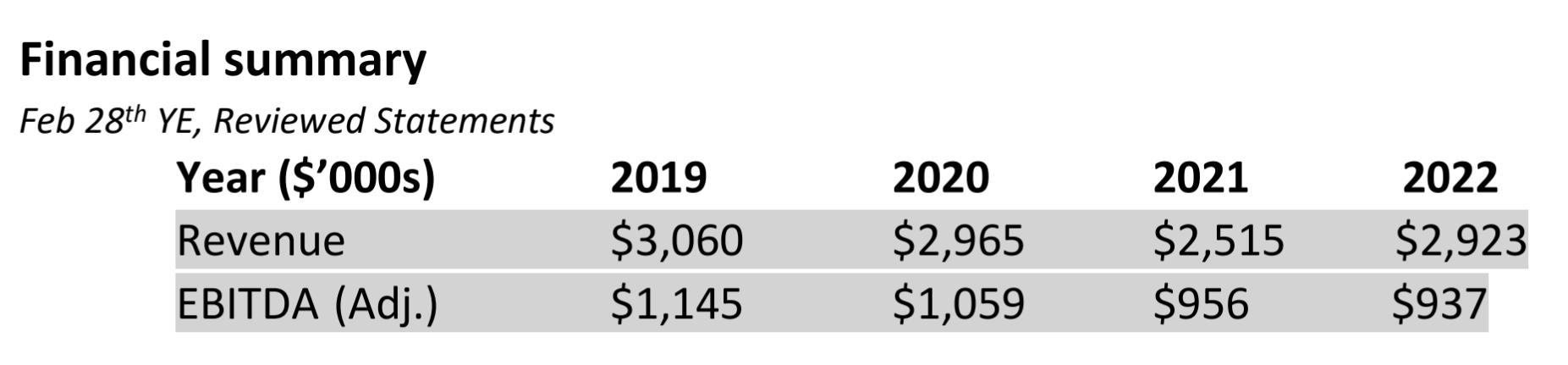

The sales figures for the past few years give you a pretty good idea about what a commercial operation can make at the end of the day.

“The company is a North American-based heat treating facility providing a broad range of treatment services including stress relieving, annealing, normalizing, vacuum heat treatment, carburizing and other services primarily used as a value-add service in the manufacturing supply chain. The company primarily serves the foundry, tool & die, fabrication, mining, commercial transport, defense, gearing and automation sectors. The business does not supply any customers in the automotive or aerospace sectors.

The shareholders have recently invested in adding new equipment and refurbishing existing furnaces to ensure that the business has one of the most diverse range of well-maintained equipment solutions in the industry. The company operates from an owned 25,000+ SF facility with sufficient capacity to double existing revenue volumes with added production labor resources. Historical revenues have been resilient and are reliant on local manufacturing activity which has been steady throughout COVID due to ongoing onshoring activities and buy-local mandates seen in the North American manufacturing sector.

The company has no outside sales presence and invests little in marketing as the shareholders have not pursued additional revenues beyond current production levels. The company employs 11 staff with the shareholders playing active roles in the business. The shareholders are approaching retirement age and are looking for a strategic investor to acquire the business. The owners are available to work with the new buyer to transition the company for up to two years in a full time capacity to provide the necessary training for incoming management personnel.

Investment highlights

• Strong financial track record with 30%+ EBITDA margins and stable historical revenue performance over the last decade and throughout the COVID pandemic.

• Available equipment and facility capacity to double current revenue levels with additional labor and management support.

• The company’s competitive positioning is its well-maintained equipment fleet and diverse range of services positioning them as a one-stop shop for OEMs and manufacturing customers.”

Did you like this article? Click here to subscribe to The Monty.

View our recent magazines and podcasts by clicking the following link. https://themonty.com/magazine/