Industrial Heating Equipment Association-Economic Report October 2021

Industry Heating Equipment Association (IHEA) always does a very good job of summarizing the business climate in North America, this is their October 2021 report; (the full report can be found at IHEA Executive Summary October 2021.pdf)

“October 2021 There is not a lot of good news to focus on these days. Or is there? The headlines have been blaring with all manner of dire warnings and as is usually the case there is far more hype than reality. The three headline issues are obvious enough – inflation at levels not seen since the 1990s, a supply chain that has been near collapse and a severe labor shortage. The fact is that all of these are related and highly predictable once one wades through the hysteria. Let’s start with inflation.

There have been those that are trumpeting idiocies such as claiming imminent hyperinflation or stagflation. These assertions are foolish in the extreme and only serve to obscure the real situation. Hyperinflation is inflation of over 50% per month – not the current rate of 5.0% per year. The hyperinflated economy is in utter collapse and one where money has no value whatsoever. Stagflation is a combination of very high unemployment and high inflation. We have inflation at 5.0% to perhaps 6.0% and a jobless rate of 4.6%. We have neither of these to deal with – we have good old-fashioned inflation driven by the three factors that always drive inflation and this situation presents challenges enough without introducing extremes.

The prime driver for higher prices is a surge in demand for these goods. Coming out of the pandemic there was a surge in demand that nobody was prepared for. The supply chain crisis was a matter of overwhelming a system that had been nearly shut down the previous year. The commodities prices soared and so did everything else connected to them. The good news is that supply driven inflation is short lived as demand fades and supply catches up – in part because of the higher prices. The second driver of inflation is a bit more worrisome as it is based on labor costs. Once these wages go up, they do not come back down easily. The pressure to hike wages to get the labor needed is driving the cost of even unskilled labor up. The final driver is the only one the Fed can react to – money supply. There is simply too much money in the system and that has prevented inflation from doing its job. Usually, the rise in price will serve as a discouragement – people will stop buying as they either can’t or refuse to. They are complaining about the higher prices but they have money and decide to buy anyway. The Fed will try to dry up the surplus that accumulated during the pandemic (over $7 trillion in excess savings worldwide) with higher interest rates, adjusted reserve ratios and other tools.

All this inflation and the supply chain chaos is a bad thing – right? Of course, to an extent that is certainly true as everybody is confronting the higher prices and the shortage of just about everything, but if one considers the reasons we are dealing with this there is most definitely a silver lining to this dark cloud. These are problems of growth. The US economy was barreling along at a 9.5% pace for the early part of Q2 in 2021. That pace slowed to 6.5% by the end of that quarter but that is still over twice as fast as the US economy traditionally grows (around 2.5% per year). These shortages and the congestion are because there has been extraordinary demand – not an actual shortage that can’t be addressed. The producers will catch up and likely within the next six months and that is when the prices start to fall again.

The one issue to be confronted by the producers is the stability of that demand. They are well aware that consumers are rushing to get back to their old habits but they are also aware that these consumers are operating with a lot of that stimulus cash and will not have the same kind of access next year. The oil producers are aware that demand is driving prices up but that demand is very fragile. The gas shortage in Europe is artificial and could vanish overnight. The real demand for oil comes from the US commuter and they have not resumed that pattern as yet. The consumer product demand is based on consumers who still lack access to their former service sector options. The metal producers are not sure when auto production ramps up. You get the drift – lots of unanswered questions that will determine just how aggressive these suppliers will want to be in the coming year.

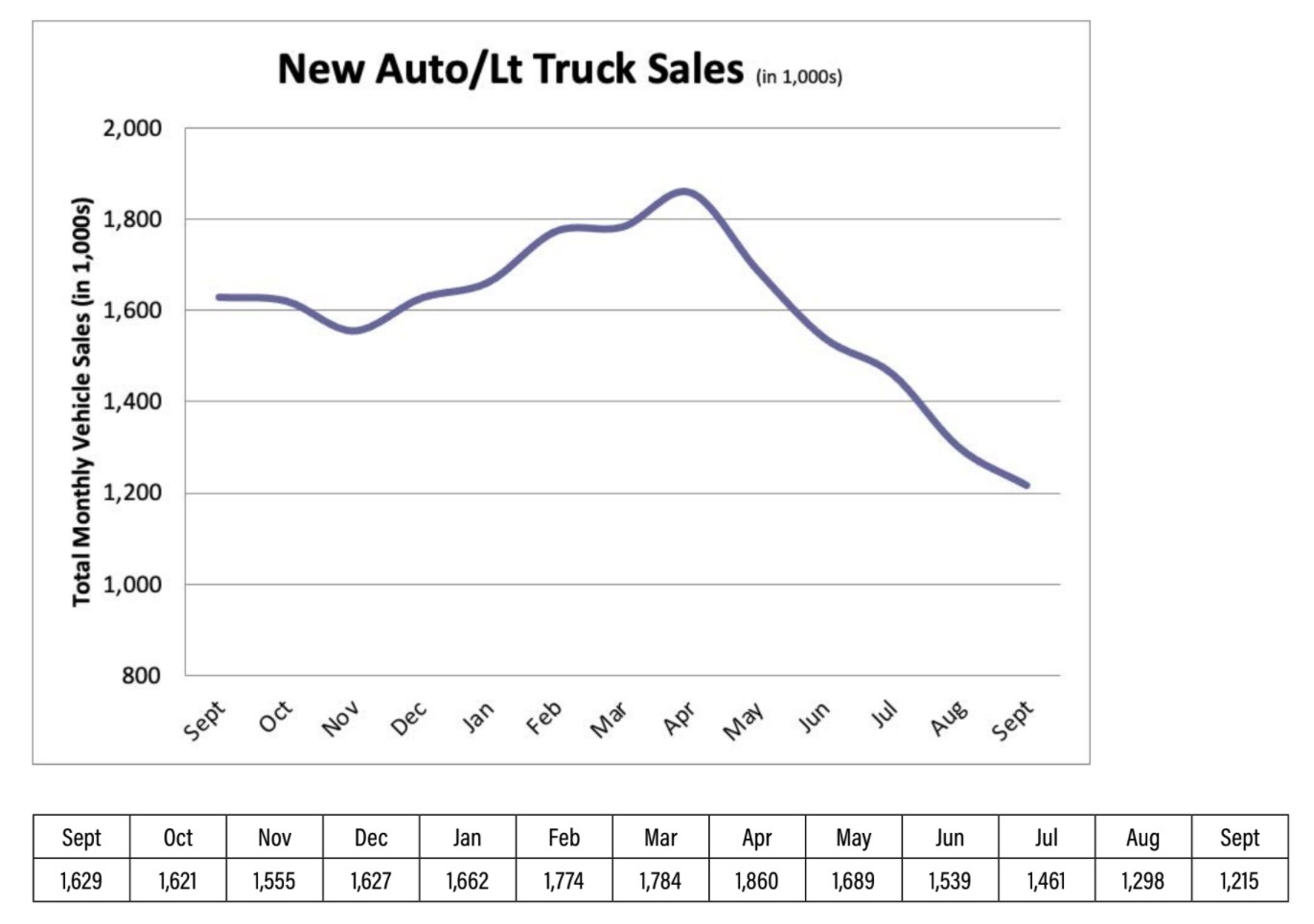

New Automobile & Light Truck Sales

This story is getting very old and frustrating for just about every sector of the automotive industry. The carmakers are still stalled by the shortage of computer chips and that stalls the tier one, two and three suppliers as well as the car dealers and of course the car buyers. Sales have fallen every month and will continue to tumble until the shortages are alleviated and right now it is anybody’s guess as to when that will be. The major producers of these chips are in full production mode but the capacity is just not there. It is not just the carmakers that need these chips, the entire electronics industry has been seeing stepped up demand and that has simply overwhelmed the ability of the producers. There are other threats emerging through all this. The global vulnerability when it comes to chips has not escaped the notice of the Chinese government. They are well aware that Taiwan remains the largest producer of these chips and the threats that have been directed at the ROC are pointed. China is fully capable of destroying Taiwanese capability in a matter of minutes. The US is now actively trying to lure production back to the US but this is not a simple or swift process.”

Did you like this article? Click here to subscribe to The Monty.

View our recent magazines and podcasts by clicking the following link. https://themonty.com/magazine/